Evergrande The Real Estate Group In Depth Report

OVERVIEW IN DEPTH

The Evergrande Group or the Evergrande Real Estate Group

(previously Hengda Group) is China's second-largest property developer by

sales, and the 122nd largest group in the world by revenue, according to the

2021 Fortune Global 500 List. It is based in southern China's Guangdong

Province and sells apartments mostly to upper and middle-income dwellers. In

2018, it became the world's most valuable real estate company.

MARKET CONDITION OF

EVERGRANDE

The Indian market witnessed massive wealth destruction on

Monday. The equity investors were left poorer by Rs 3.78 lakh crore, as their

total wealth represented by BSE market capitalization declined to Rs 255.18

lakh crore. This means they lost over Rs 1,000 crore per minute!

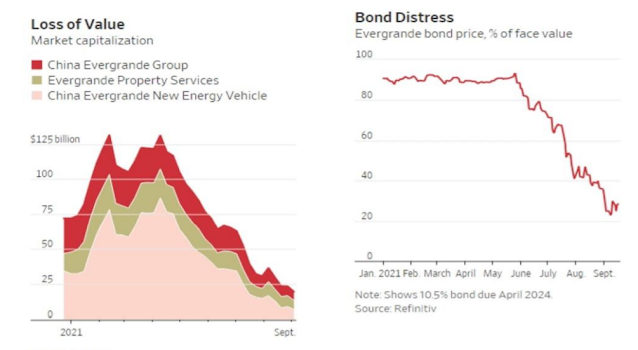

MARKET CAPITALIZATION & BOND TREND

As per various media reports currently, around 60 to 65

million units are vacant representing more than 21% of all homes in urban

China. Any default would start a selling frenzy in the housing market pushing

down prices further. As real estate accounts for a large store of wealth for

Chinese citizens, a deep price cut would severely impact consumption. According

to Bank of America, Evergrande is the largest high yield dollar bond issuer in

China, accounting for 16% of outstanding notes. Evergrande collapse may push

the default rate on the country’s Junk dollar bond market to 14% from 3%. Such

a spike in default rate could spill over to the rest of the high yield market

in China and other bond markets. Experts believe that the High yield credit

market may go for a toss in case of Evergrande default and contagion may spread

to other markets like equity market and investment-grade corporate bond

markets.

China’s economy is highly leveraged. According to the Institute of International Finance, the total debt of China stands at $92 trillion and the debt to GDP ratio at the end of June quarter stood at 353%. With such a high GDP to debt ratio, any slowdown due to real estate companies' default could put China in a tough spot as the government has less space for fiscal maneuvering. A collapse of Evergrande will have a large impact on the job market as it has 200,000 staff and hires 3.8 million people every year for project developments.

Markets were spooked on Monday with America’s S&P

falling 1.7% after Evergrande closed 10% down in Hong Kong – the lowest since

May 2010. But the territory’s Hang Seng index recovered on Tuesday, closing up

0.5%, and the S&P has also regained lost ground. Around 50% of revenue for

Europe’s luxury goods sector comes from China. Any slowdown in China will

impact European luxury markets. European powerhouse Germany exports over 10% of

its total export to China. Any slowdown in China will make economic recovery

hard for already aging and slowing Europe. China holds over $1.1 trillion US

bonds and treasury notes. To pay dollar-denominated liabilities of Chinese real

estate companies, China may choose to either sell this debt or devalue the

yuan. In both the conditions, the tension between the US and China may be

stretched further

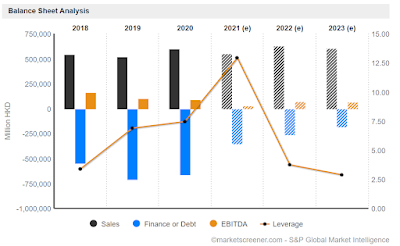

ANALYZED FINANCIALS FOR

EVERGRANDE

Comments

Post a Comment